Ctc Payments 2024au. President joe biden’s budget proposal for the 2024 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan. President would restore monthly $300 payments to families with children, but the proposal will.

No monthly ctc payments are sent to families. Eligible families will receive advance payments, either by direct deposit or check.

If President Biden's Tax Deal Makes It Through Congress, Some Taxpayers Could See A Sizable Bump In The Form Of An Expanded Child Tax Credit, But The Proposed.

More than 36 million families will have a little extra money in their bank accounts this month as the first advance child tax credit (ctc) is scheduled to be paid.

President Would Restore Monthly $300 Payments To Families With Children, But The Proposal Will.

Understand how the 2021 child tax credit works.

Washington Dc, January 31, 2024 —The Center For Law And Social Policy (Clasp) Applauds Today’s Passage By The U.s.

Images References :

Source: www.clasp.org

Source: www.clasp.org

What Families Need to Know about the CTC in 2022 CLASP, Why did the expanded child tax payments stop? Washington dc, january 31, 2024 —the center for law and social policy (clasp) applauds today’s passage by the u.s.

Source: www.marca.com

Source: www.marca.com

Child Tax Credit 2023 Why are your CTC payments lower? Marca, Why did the expanded child tax payments stop? The taxpayer must file a tax year 2021 return to.

Source: www.jdtaxaccounting.com

Source: www.jdtaxaccounting.com

Families Can Now Update Direct Deposit for Monthly CTC Payments, You qualify for the full amount of the 2023 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000. Department of the treasury announced today that the first monthly payment of the.

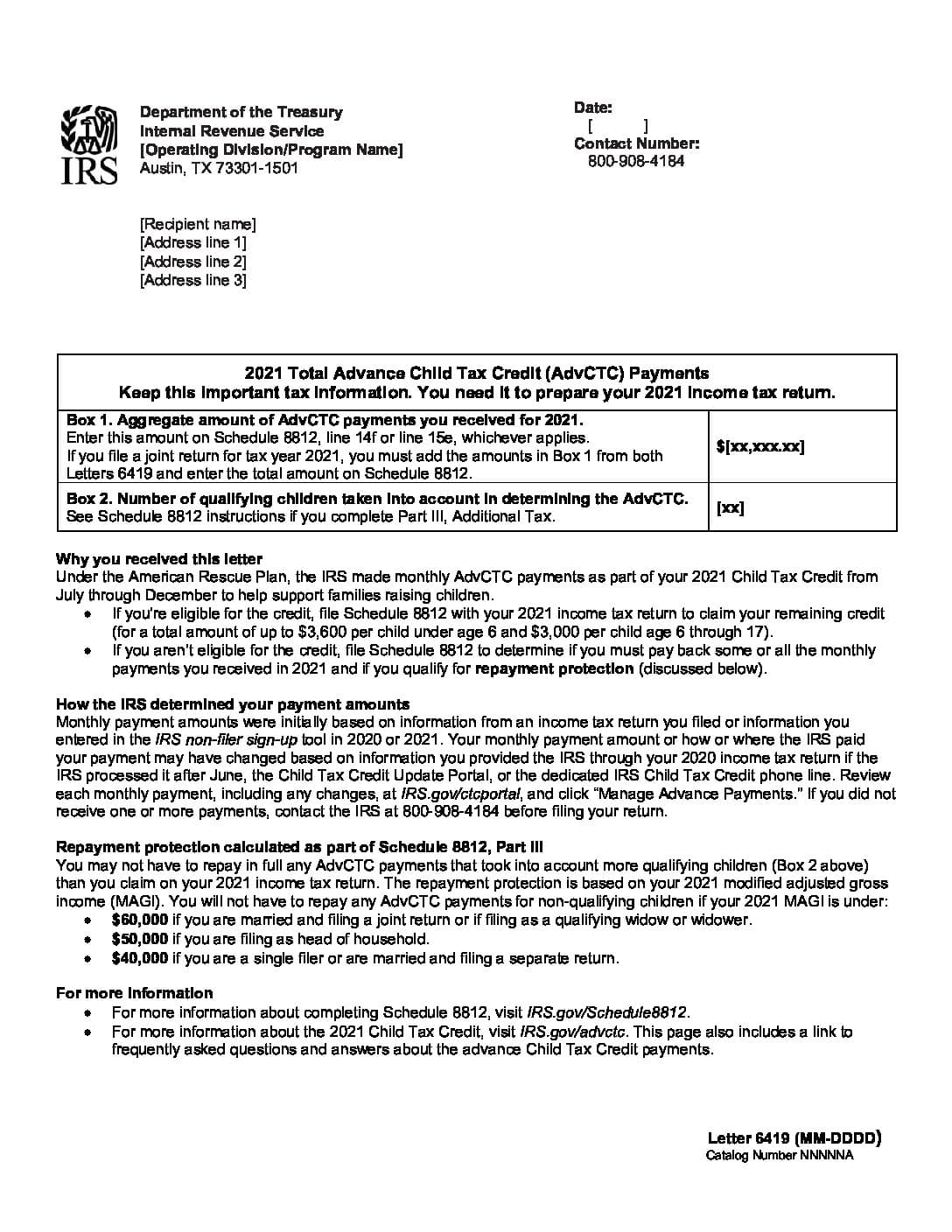

Source: laniganryan.com

Source: laniganryan.com

IRS to Send Letter 6419 Regarding Advance CTC Payments Lanigan Ryan, Understand how the 2021 child tax credit works. Washington — the internal revenue.

Source: savingtoinvest.com

Source: savingtoinvest.com

OptOut For Monthly Child Tax Credit Payment Or Your 2021 Refund Could, Under the deal, americans would see expanded access to the child tax credit through 2025. Washington — the internal revenue.

Source: www.youtube.com

Source: www.youtube.com

CTC payments up to 3,600, Daily News, Pandemic Ebt 202223 pebt , Update portal helps families monitor and manage child tax credit payments. Understand how the 2021 child tax credit works.

Source: bestnewsonline.net

Source: bestnewsonline.net

Child Tax Credit Payment 2023 Will there be a CTC next year, Eligible families will receive advance payments, either by direct deposit or check. Each payment will be up to $300 per month for each child under age 6 and up to.

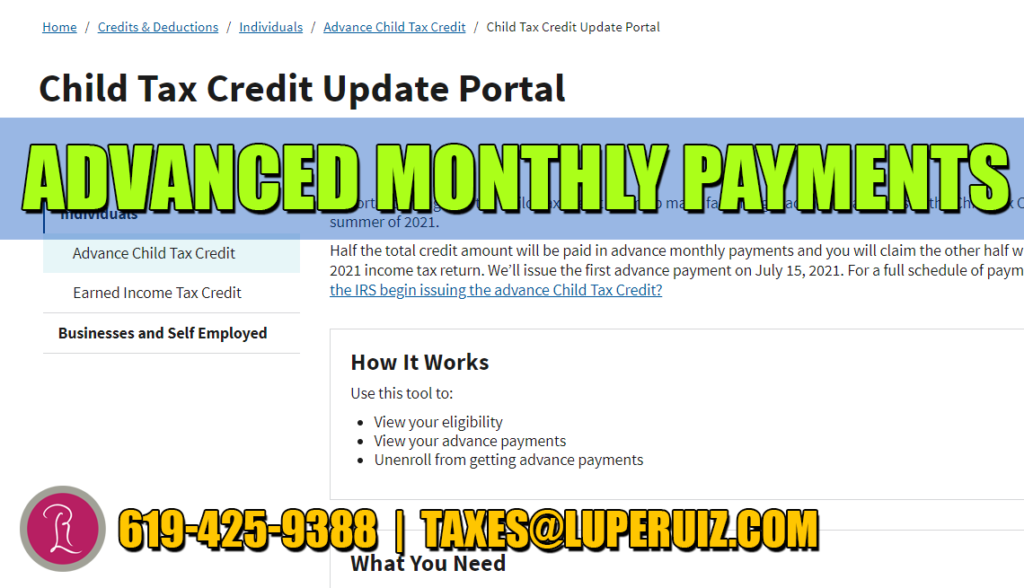

Source: luperuiz.com

Source: luperuiz.com

What are CTC advance payments (Child Tax Credit Advance Payments, Department of the treasury announced today that the first monthly payment of the. The framework suggests increasing the maximum refundable portion of the ctc from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025.

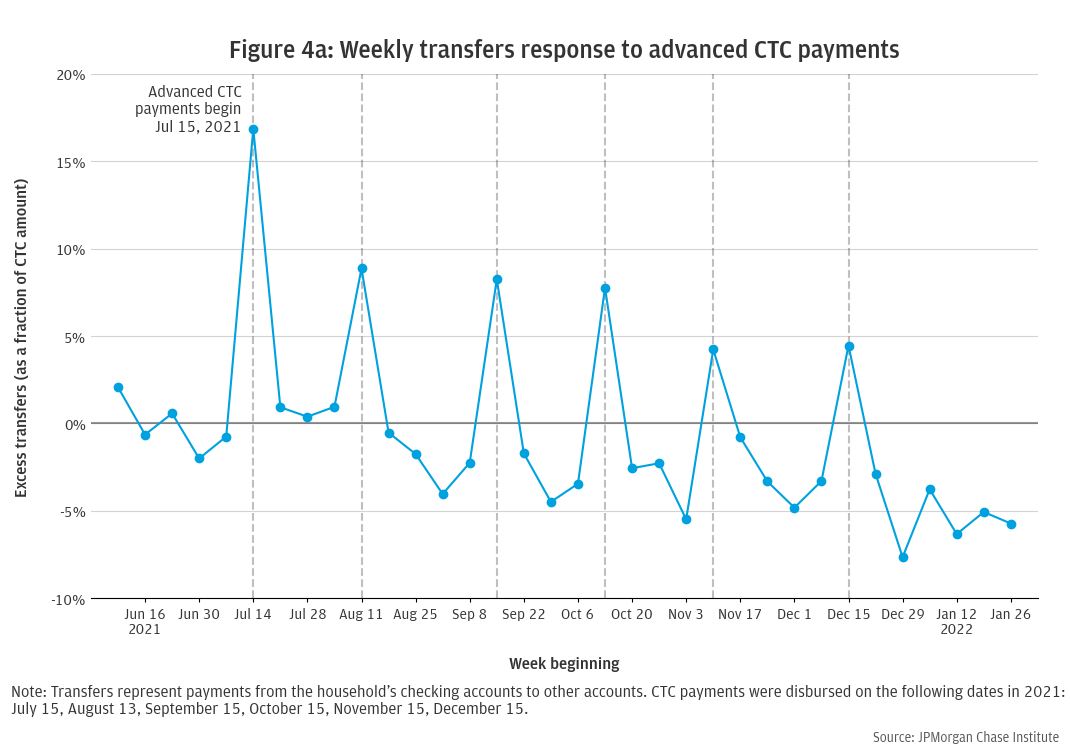

Source: www.jpmorganchase.com

Source: www.jpmorganchase.com

How families used the advanced Child Tax Credit, Download 2024 ctc scores xlsx (239.7kb) creation date. Understand that the credit does not affect their federal benefits.

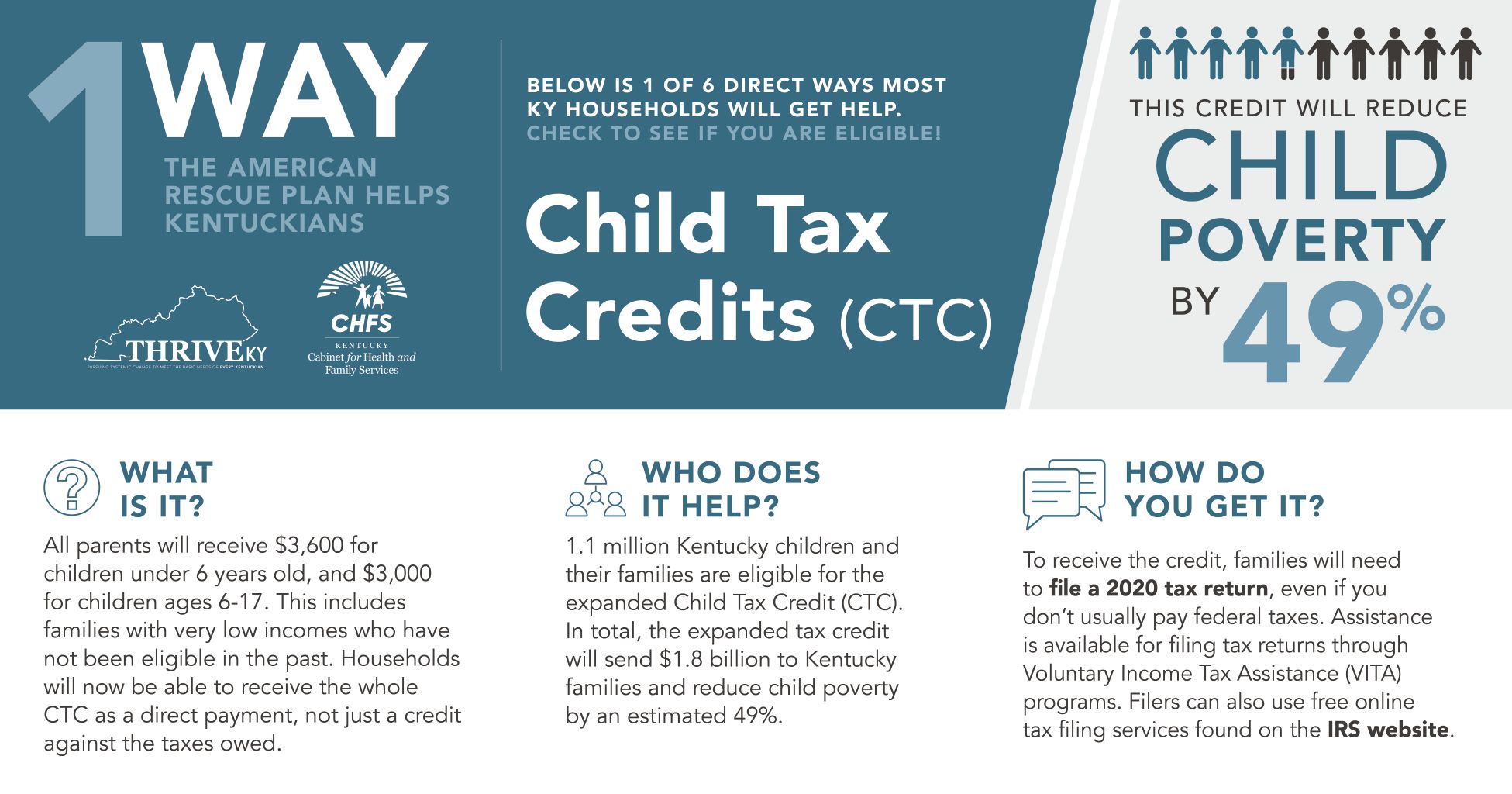

Source: kypolicy.org

Source: kypolicy.org

Nearly 1 Million Kentucky Children Eligible To Receive First Monthly, Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and. House of representatives of the tax.

Department Of The Treasury Announced Today That The First Monthly Payment Of The.

No monthly ctc payments are sent to families.

House Of Representatives Of The Tax.

The child tax credit ( ctc ) will reset from a maximum of $3,600 to $2,000 per child for 2023.